Abstract

Research overview and methodology

This project develops a reproducible hybrid machine learning–econometrics pipeline for program-level analysis across heterogeneous institutional settings. The framework emphasizes transparent feature construction, identification-aware modeling, and systematic robustness diagnostics across multiple specifications. Empirical evaluation focuses on cross-model comparability, stability under alternative assumptions, and interpretability of estimated effects. The full pipeline is designed to support rigorous analysis, replication, and extension.

Project Artifacts

Explore detailed documentation and analysis summaries

System Architecture

Explore the modular workflow and diagnostic framework that powers our reproducible research pipeline

System Architecture

Data Engineering & Harmonization Layer

Deterministic preprocessing, harmonization, train-index enforcement

Stability & Quality-Control Gate

Missingness, variance, and structural integrity checks

Hybrid Modeling Layer

FE · Clustered OLS · ElasticNet (triangulated estimation)

Diagnostics & Validation Engine

Nonlinearity, influence, SHAP, rolling forecasts

Artifact & Reproducibility Manager

Metadata, manifests, model artifacts, logs

The architecture consists of a deterministic, modular workflow that moves from data engineering and stability validation to hybrid modeling, diagnostic evaluation, and artifact management. Each layer communicates through structured, version-controlled outputs, ensuring reproducibility, transparent auditing, and methodological consistency across the entire empirical pipeline.

System Pipeline

RAW DATA INGESTION & LOADING

WDI & WGI retrieval, validation, schema alignment

IDENTIFIER & VARIABLE HARMONIZATION

ISO3 normalization, year indexing, indicator mapping

DETERMINISTIC PREPROCESSING

Imputation, coercion, outlier handling, feature screening

STANDARDIZATION & SCALER PERSISTENCE

Train-sample fit-transform, persisted scaler metadata

TRAIN-INDEX CONSTRUCTION

Deterministic row filtering, FE/OLS/EN parity

MODEL ORCHESTRATION

FE, clustered OLS, ElasticNetCV, triangulated estimation

DIAGNOSTICS & VALIDATION

Nonlinearity, influence, SHAP, rolling forecasts

ARTIFACT EXPORT & REPRODUCIBILITY

Models, metadata, logs, figures, manifests

A deterministic workflow that converts raw macroeconomic indicators into harmonized, standardized, and model-ready datasets before orchestrating hybrid estimation, diagnostics, and forecasting. Each stage exports structured artifacts, enabling reproducible analysis across all model classes

System Diagnostics

Model Output

Predictions, residuals, standardized coefficients

Diagnostics Engine

Unified framework for structural and statistical validation

Nonlinearity Diagnostics

LOWESS, GAM smooths, turning-point detection

Residual Structure

Distribution shape, partial residuals, added-variables

SHAP Interpretability

Dependence paths, global feature importance

Temporal Validation

Expanding-window CV, RMSE curves, bootstrap CIs

Validated Analytical Artifacts

Diagnostics, figures, logs, reproducible metadata

The system applies five parallel diagnostic modules—nonlinearity analysis, influence assessment, residual structure evaluation, SHAP-based interpretability, and temporal validation—to ensure that model outputs are structurally stable, interpretable, and robust under heterogeneous macroeconomic conditions.

Core Results Summary

Comprehensive empirical findings at a glance

Loading visualization...

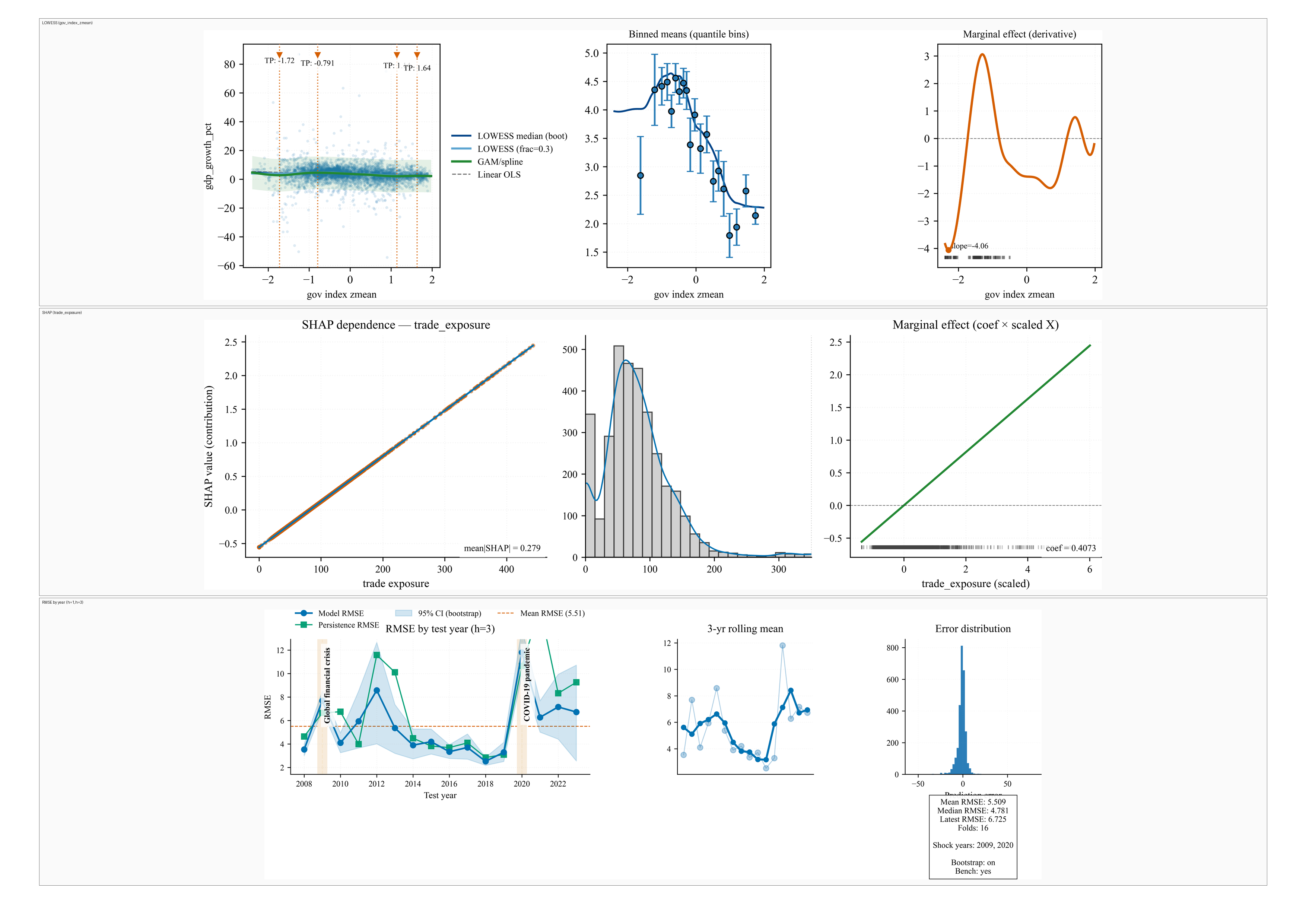

This composite summarizes the core empirical behavior of the proposed hybrid machine learning–econometrics system. Nonlinearity diagnostics (LOWESS and binned means) reveal smooth, stable relationships, with governance exhibiting curvature consistent with short-run reform effects rather than instability. SHAP dependence and coefficient-based marginal effects jointly confirm a strong, monotonic contribution of trade exposure, validating cross-method interpretability. Rolling out-of-sample forecasting demonstrates stable performance outside global shock periods, with well-behaved error distributions, indicating robustness, temporal stability, and absence of overfitting.

Plot Explorer

Select a category to view diagnostic plots and visualizations

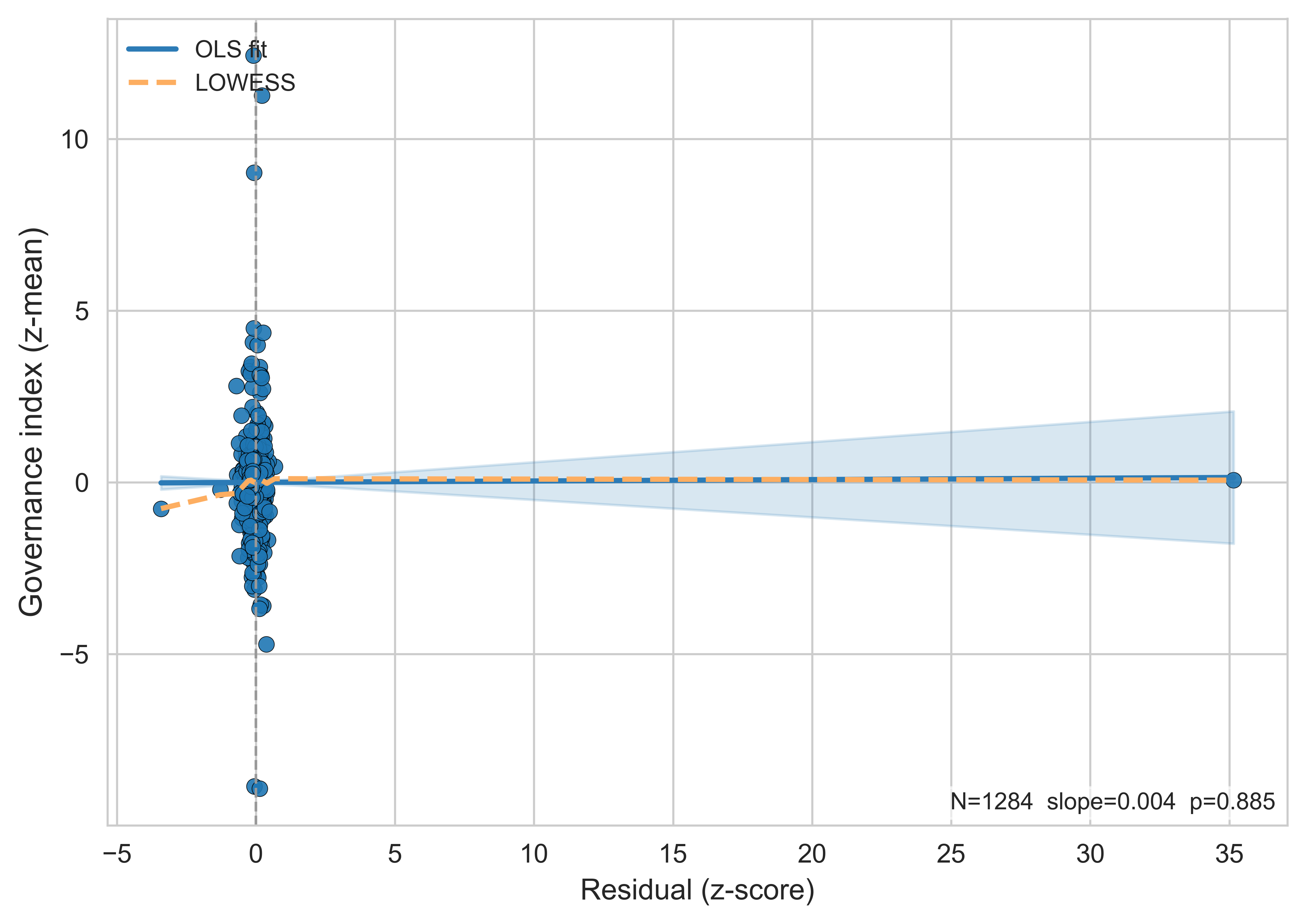

Government Index

Residual diagnostics show no systematic relationship between governance and model errors: both OLS and LOWESS fits are flat with an insignificant slope (p = 0.885). This indicates no residual structure or misspecification linked to governance.